What is the Most Profitable Insurance to Sell | 10 Insurance to Sell

As an insurance agent, you understand how critical it is for your clients to have adequate insurance coverage. It protects clients from a wide range of perils, including damage to or theft of their vehicle. Let’s learn what the most profitable insurance to sell is.

On the other hand, Independent insurance agents will likely be up against solid competition. As an insurance agent, you need to know the most lucrative insurance product to generate money quickly.

You’d like to use various strategies and techniques to stay ahead of your competition and outperform other insurance businesses and insurance agents in the insurance market. When it comes to achieving this, one of the most effective methods is to use the concept of supply and demand.

In other words, you should do what your customers want you to do. You can save time and effort persuading customers to buy your products. So, as an insurance agent, here are some of the most profitable policies to sell so that you may give your customers what they want.

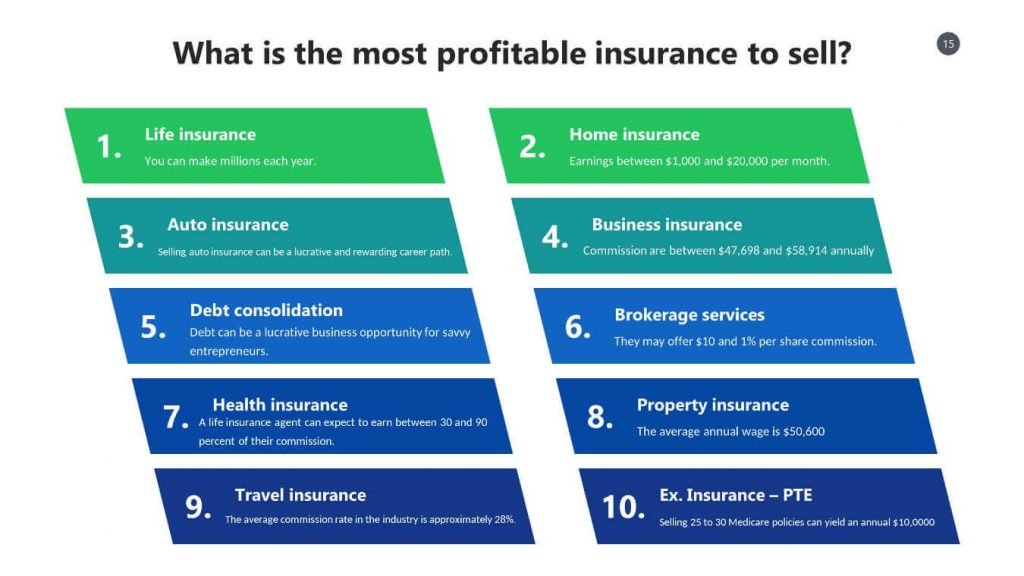

What is the Most Profitable Insurance to Sell?

Life Insurance

Because insurance salespeople are entirely reliant on their clients’ premium payments, it is the ultimate commission job.

Unlike the other professions, selling insurance typically pays less at first, but the longer you work there, the more money you make. You can make millions each year.

Those with credentials like chartered life underwriters are the most successful and well-respected agents.

Agents must be resilient and able to take criticism. After all, they are all essentially selling the same goods. If dealing with clients and building relationships aren’t your strong suits, you might want to pass on this job.

Those with the means, fortitude, and resources to endure the dry spells are the successful agents.

Home Insurance

There is no limit to how much money you can make selling insurance if you are willing to put in additional effort. Once everything is up and running, it is possible to earn a great deal of money in the insurance sales industry. In their early careers, most experts report that earnings are between $1,000 and $20,000 per month.

Auto Insurance

Despite having minimal entry requirements, selling auto insurance can be a lucrative and rewarding career path. Those with an entrepreneurial spirit and a strong desire to succeed may find this appealing. You can apply for your license after securing employment, but you cannot begin selling until you’ve been granted one.

People generally believe that insurance agents are well-compensated, work in a pleasant environment, and have a low-stress occupation. Although some insurance agents earn six-figure salaries, commissions make up most of their income.

Commissions account for more than a quarter of an auto insurance agent’s average income. However, because most insurance agents are well compensated, their income is not dependent solely on sales commissions.

Business Insurance

An insurance agent’s average salary and commission are between $47,698 and $58,914 annually. In 2020, the lowest 10% of insurance agents will earn less than $29,000, while the highest 10% will earn more than $127,840.

Consequently, even the lowest 10 percent of insurance agents earn close to the median income in the United States, while the highest 10 percent earn more than four times that amount. Insurance agents are incredibly prosperous.

The ability to sell new insurance policies on the market directly impacts the total income of an insurance agent. To earn more money as an agent than the average, you must familiarize yourself with the available resources.

In contrast, captive agents benefit significantly from national brand recognition. Due to higher commissions and the ability to “shop” multiple insurance companies, brokers can provide their clients with the best policies at the lowest prices.

Debt Consolidation

Debt consolidation businesses assist people in consolidating multiple loans into one. Consolidating your debt into a single loan with better terms and a lower interest rate makes paying it off easier. Businesses in this industry rely on debt consolidation payment processing to accept payments.

Debt can be a lucrative business opportunity for savvy entrepreneurs and business owners if you’re willing to put in the effort.

You will need a way to accept payments from your customers, either online or in person, as a business owner (depending on how your business is structured). If you have a merchant account, you can accept debit and credit card payments more easily and securely. As a business owner, you must take this step to ensure your company’s success.

Brokerage Services

Brokers charge commissions and fees to cover expenses when a trade is executed. Other brokers generate profits by inflating asset prices artificially or betting against traders to limit their losses.

A select number of brokers do not mark up the spread and instead charge per share. They may offer $10 and 1% per share commission for minimum order sizes. For instance, if you wish to purchase ten shares before selling them, each transaction will cost you $10.

Few brokers will charge any or all of these fees. Most frequently, brokers who trust in and out commissions are contrasted with those who do not but mark up the spreads.

Brokers can hedge the entire company’s exposure or the exposure of specific clients, such as prominent traders.

Despite how odd this may appear to you, it’s not that bad. There are numerous advantages to trading with a reputable market maker, but only if your broker interferes with your transactions.

Health Insurance

A life insurance agent can expect to earn between 30 and 90 percent of their commission in their first year on the job. After the first year, an agent receives a renewal or trailing commission equal to a percentage of the annual premium.

Property Insurance

The average annual wage is $50,600. However, some factors come into play here, so you must first decide what kind of agent you want.

A life insurance agent typically earns $79,730 per year. An insurance producer’s average yearly salary is $55,417. After the end of the calendar year, contingent commissions can be calculated.

For instance, if Jones Insurance sells $10 million in new property insurance policies in 2020, Elite Insurance will pay Jones a contingent commission of 2%. The Jones Agency will not know if it has achieved its objective until early 2021. If this occurs, Jones will be awarded the commission. So, it is a very profitable business.

Travel Insurance

While commission rates can range from 10% to 40%, the average commission rate in the industry is approximately 28%. Based on this information and average calculations, a travel agent could earn $12,442 annually if they sold a travel insurance policy with every trip booked.

The weekly wage of a Travel Insurance Agent in the United States is $1197.

Because a commission is paid before a client’s departure, the bottom line of an agency benefits; additionally, it offers customers added security and peace of mind.

Insurance – PTE

Selling 25 to 30 Medicare policies can yield an annual $10,000. Despite the substantial amount, this is just the beginning. As long as clients remain in your clientele, you will continue to receive renewal income. With 30 clients, a renewal rate of $270 per year would generate a passive income of $675 per month.

Four to eight policies would be sufficient in the second year to reach your goal of $10,000. After selling 30 more policies in the third year, you would have $16,000 in renewal income in addition to your commissions.

Conclusion

Health, Life, property, and casualty insurance are a few available options.

Life offers its affiliates the maximum commission rate possible for a new sale. Renewal commissions are incredibly minimal. As a result, life insurance brokers can earn a sizable salary, but they must continuously promote their services. This is the place to be if you’re trying to make money quickly.

Health insurance has some of the lowest commission rates, but the costs keep rising. Because premiums are so high, a health insurance agent might make a sizable salary. When it comes to health insurance, it’s not uncommon for the agent to spend a significant amount of time figuring out why the doctor’s bill isn’t being paid.

So, it is possible to save service hours and maximize commissions by selling large health insurance plans to large groups.

Cars, buildings, and equipment are all covered by property and casualty insurance. The fees are reasonable. Ensure your target market is large enough to earn a high per-customer premium/commission to maximize your profits.

So, a good book of business doesn’t take many clients who own multiple vehicles and homes, but it does require many people who own one vehicle that serves as their primary residence. Again, premiums and earnings will rise if you can sell to large corporations. With this form of insurance, you’re always looking to the future.