Home Insurance Premium Calculator | Calculate Premium Now!

It might be challenging to compare house insurance quotes. Even if you believe your house is quite simple, the insurance rates you have been given may not be immediately obvious. Thus, we have made this post on the home insurance premium calculator to aid you.

In return for the coverage provided by your insurance policy, the firm will charge you fees. The insurance premium is the name for the price. You could pay the premium monthly or semi-annually based on the insurance coverage. In certain circumstances, you may have to pay the whole sum in advance before the coverage begins.

The majority of insurance carriers provide numerous payment options. This covers electronic choices, scheduled repayments, and credit and debit cards. You could be entitled to a discount if you choose paperless billing alternatives or pay the whole amount in one go rather than making minimum installments. The Home Insurance Premium Calculator will be your best ally at this point. Come along as we elaborate more on this below.

What is Home Insurance?

Home insurance is a kind of property coverage that safeguards a person’s house and other belongings against losses and damage. Every house insurance policy includes a risk limit, which establishes how much protection the insured would have in an unexpected event.

Home warranties and mortgage insurance shouldn’t be confused with home insurance. A house insurance policy often covers four types of accidents on the insured property: interior damage, outside damage, loss or damage to personal goods, and injury sustained while on the premises. The homeowner will be forced to pay a threshold, which is effectively the purchaser’s out-of-pocket expenses when a claim is filed for any of these occurrences.

Every house insurance policy includes a liability limit, which establishes how much protection the insured would have in an unexpected event. The policyholder may choose a larger maximum than the normal $100,000 standard limit.

The liability restriction specifies the portion of the sum insured that would go into replacing or fixing things to the property facilities if a claim is filed. Additionally, fees are associated with moving personal possessions and living elsewhere while the home is just being repaired.

What is a Home Insurance Premium Calculator?

A calculator for property insurance premiums may also be used for house insurance premiums. To assist prospective policyholders in comprehending the associated expenses of purchasing a house insurance policy, insurers have made this online tool available. Many calculators for house insurance premiums ask for information like the current home worth, the current value of the assets you need to protect, and the length of the policy you choose to calculate the price.

It is crucial to understand that each insurer calculates the premium for home insurance plans differently and that many factors influence the premium. As a result, the information needed by the house insurance calculator may vary.

Home Insurance Premium Calculator

How Much Does Home Insurance Cost?

For $250,000 in housing coverage, the national average cost of homeowner’s insurance is $1,325 per year. However, some things affect how much your house insurance will cost. The physical location has a big impact on premiums.

For instance, certain regions of the nation are more vulnerable to natural catastrophes than others, and reconstruction expenses may be greater in some regions. Your ultimate home insurance cost will also significantly affect your policy choices, such as dwelling limitations.

How to Calculate Home Insurance Premium

If you have a house insurance policy, you may be curious about how insurance companies determine your prices. You must pay insurance premiums for plans that protect your house and other assets. Your age, the coverage you choose, and the quantity you need all go into the cost. This is also considered with your data, your ZIP code, and other elements.

Overall, this method may calculate the premium for home insurance. Monthly insured amount x Insurance Premium Rate equals the monthly insurance premium.

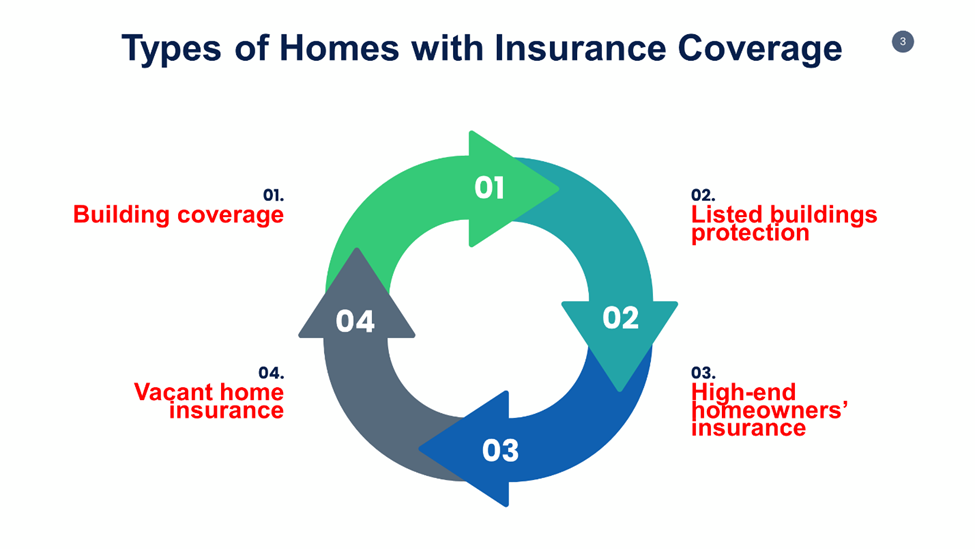

Types of Homes with Insurance Coverage

Some Types of Homes with Insurance Coverage include:

Building coverage

A kind of insurance covers the structure of your house for homes called buildings insurance. This is in addition to any fixed features, such as your roof, sanitary fittings, and kitchen appliances. Typically, exterior structures are covered by this sort of house insurance. Thus, it is advisable to protect garages, sheds, and conservatories. This insurance usually won’t cover fences, walls, or gates.

Although it is not required, your mortgage lender could request that you get buildings insurance. It may be purchased alone or as a package dealing with structures and insurance coverage.

It’s a smart option to get building insurance as soon as you swap contracts if you want to do so. If anything bad occurs to the building before you move in, you’ll be protected in that case. You must calculate the cost of rebuilding your house before requesting a quotation for buildings insurance. This might be challenging because this cost will be distinct from your home’s market value.

Don’t forget to inform your insurance if you’ve had construction work done, such as installing a new kitchen, since your house will now cost extra to rebuild due to the addition.

Listed buildings protection

If you’re fortunate enough to reside in a home with sentimental value to the country, the odds are high that it will be put on the market. The historical and cultural relevance will determine if that designation is Grade I, II, or III.

These structures have a specific status. Thus some regulations may increase the cost of repairs. Living in a listed property doesn’t imply you can’t make alterations; it only makes the process more challenging and time-consuming.

High-end homeowners’ insurance

High-net-worth house insurance is another name for high-value home insurance. The cover is divided into two categories, like typical policies—buildings and contents.

High-value buildings are often defined as structures costing upwards of $500,000 to replace. However, this amount might change depending on the insurance.

Jewelry, priceless antiquities, and works of art are examples of high-value content. A single-item value cap is often included in standard material policies. As a result, you may not be able to sue for the entire value of a stolen art picture.

This additional value is accommodated by a high-value house insurance policy, giving you an extra level of security.

Vacant home insurance

Insurance is available if you need to cover an empty home, such as an inherited house. Uninhabited or empty house insurance will provide coverage for a vacant property for a longer time than standard home insurance.

Due to the heightened danger of theft, home insurance usually dislikes houses being vacant for more than 30 days. With empty house insurance, you should be protected from vandalism, fire damage, and water damage. Additionally, you may choose how long you want the cover to last. The length of a policy might be from two months to a year.

Understanding Home Insurance Premiums

Your home insurance premium is the sum of money you pay each month to maintain the status quo of your insurance contract. You may usually pay your homeowner’s insurance premiums in three ways: monthly, quarterly, or yearly.

Your mortgage provider will often have your house insurance premium if you have a mortgage. This is frequently paid for to safeguard their investment as part of your monthly mortgage payment. Your borrower will then provide this to your property insurance each year.

When calculating homeowner’s insurance rates, multiple aspects of you and your house are considered. The insurance provider will consider some rating variables when you buy a new home insurance policy to establish your rate.

The following are typical elements that affect house insurance premiums:

Protection amounts

The quantity of coverage you need is a key element in calculating your home insurance rate. Most home insurance companies include a valuation calculator you may use to figure out how much it would cost to rebuild your house if it were declared a complete loss from one of the insured perils. This policy will be identified as housing coverage on your disclosures page, often known as Coverage A.

The majority of the other coverages vary by carrier and are normally calculated as a portion of the housing cover. If extra coverage is required, these coverages may often be expanded individually.

Location

Another significant aspect of determining your home insurance price is the location of the residence. Insurance companies compile information on the home’s ZIP code, including the likelihood of crime, extreme weather, and natural catastrophes. The possibility of a higher premium increases with the likelihood of you claiming that ZIP code.

It also depends on how close you are to the closest fire hydrant and fire station. The more money you can save on your home’s insurance rate, the closer you are. The more properties insurers are willing to give coverage in the region, the more advantageous your rate will be, and the lower your protection class will be.

Features of the house

Your house insurance rate is established based on your home’s size, architectural style, and year of construction. Larger, older, or homes built with less resilient materials often cost more to insure.

Deductible

Your policy deductible is the sum you are obligated to fork out before your insurance begins to reimburse the balance of the damage. Increasing your home insurance deductible is the simplest and fastest strategy to reduce your insurance price. Remember that if anything unfortunate happens to your house or possessions, a greater deductible will result in higher out-of-pocket costs.

Insurance rating

When calculating your rates, your insurance provider will also consider your insurance score, often known as your credit-based insurance score. Some (but not all) of the variables in your credit history are considered when calculating your insurance score. This serves as a gauge for your claim-filing propensity. Your house insurance rate will be cheaper and better your credit score.

History of claims

Your rates won’t likely change if you’ve never made a home insurance claim or if you’ve only done so once every three to five years. However, your insurance provider will probably raise your costs if you’ve made many claims, especially theft, water leaks, or foundation problems.

Frequently Asked Questions

What is the 80/20 rule in home insurance?

The vast majority of house insurance providers follow the 80/20 rule. The criterion states that if a landowner has insurance coverage equivalent to at least 80% of the entire replacement cost of the residence, the insurer will only pay for damage to a house or other property.

The insurance provider will only compensate the homeowner for a proportional fraction of the necessary basic coverage that must have been obtained if the quantity of coverage bought is less than the requisite 80%.

What is used to calculate the premium of a property policy?

The following factors are used to calculate the premium of a property policy:

- Your age

- The sort of protection you want

- The degree of protection you need

- Personal data about you

- Your ZIP

What is the average cost of homeowners insurance?

For $250,000 in housing coverage, the national average cost of homeowner’s insurance is $1,383 per year.

Does my age affect home insurance?

Although age often affects vehicle insurance prices, it shouldn’t influence your house insurance. One exception: Some insurance companies could provide older people discounts.

How much should I have my house insured for?

Most homeowner’s insurance plans provide liability coverage of at least $100,000. However, greater limits are available, and homeowners are widely advised to consider getting liability coverage worth at least $300,000 to $500,000.

Expert Opinion

How much house insurance will cost might be one of your key concerns. The cost of house insurance is a result of this. This sum, which is included in a company’s home insurance estimate, will let you know how much the coverage will cost, given the coverage you choose and any applicable discounts.

Home insurance is a must, not a luxury. And not merely because it defends against burglary and harm to your valuables and property. Almost all mortgage lenders demand that borrowers have insurance covering the home’s full or market value. Furthermore, they want evidence before they can lend money or fund a residential real estate deal. Thus, the Home Insurance Premium Calculator will aid you.

References