Resident Shield is not the best choice for most renters because its basic coverage costs much more than its competitors. Also, not all renters get the same level of customer service because different companies write resident shield policies. This guide is about resident shield insurance reviews.

Even if your landlord recommends Resident Shield, you might want to buy insurance elsewhere. Even if you have renters insurance, you don’t have to buy it from a specific company.

What is Resident Shield Insurance?

Renter’s insurance covers both property and liability claims. The landlord is responsible if you suffer injuries due to a building defect. Renters’ insurance coverage extends to studio apartments, houses, and mobile homes.

Renters insurance is likely the cheapest and easiest-to-obtain insurance you’ll ever own. So, it may be worthwhile even if you’re starting or plan to remain in your current location for less than a year. You probably have more valuables than you could afford to replace in case of a significant break-in or fire.

Most renters reside in apartments, and regardless of how cautious you are, you have no control over your neighbors. They may forget to close the security gates, buzz in unwelcome visitors, or even fall asleep while smoking and start a major fire.

Types of Resident Shield Insurance

You will only see prices to give you an idea of what to expect. You should call the insurance company or agent directly to get the right quotes.

Nationwide

Pros: The primary policy covers credit cards you lose or someone else steals you. It covers any changes or upgrades you paid for in a rental unit.

Cons: To buy a policy, you must work with an agent.

Nationwide is one of the biggest insurance companies, so people who want to buy renters insurance through an independent agent should consider it.

Policyholders can easily file claims through their online account or by calling customer service, which is open 24 hours a day, seven days a week.

Lemonade

Lemonade’s pros: It’s easy to sign up and get paid. Your chosen charity will get some of the money that was raised.

Cons: It’s harder to find this company than others on our list. This might not be a good fit if you work with an agent.

One thing that makes Lemonade stand out is that it uses artificial intelligence (AI) to complete signing up and make a claim quickly. Lemonade says that it can approve your renter’s insurance claim in seconds. All this depends on what your claim is for. Lemonade also donates unclaimed premiums to charities, and customers can choose which ones to help.

Policyholders can add coverage for high-value items like jewelry or electronics, and you may be able to file claims without having to pay a deductible.

Erie Insurance Company

Pros: More than 13,000 brokers in the area.

Cons: They don’t have as many choices as some of the other companies we looked at. Fewer discounts than some of the other businesses we looked at.

Those who qualify can take advantage of low rates and more than 13,000 local agents. By combining their auto and renters policies, applicants can save money and competitive prices.

If you have a policy, you can sign in to your account to see how your claims are. The standard policy covers injuries or damage to other people’s property. It covers extra living costs if your home can’t be lived in. In addition, if personal items were lost because of a covered loss. Policyholders can also get additional coverage for earthquakes, expensive items, and identity theft.

State Farm

Pros: You can get insurance to cover the cost of replacing the item. It only keeps some mold away.

Cons: It’s harder to find this company than others on our list. Farmers Insurance is available in 39 states, and most people who want a quote can do it online. Farmers’ basic coverage includes:

- Reimbursement for lost, damaged, or stolen items (up to a specific limit).

- Reimbursement for extra living costs if you have to move.

- Liability coverage.

- Guest medical coverage.

- The cost of replacing personal property.

- Protection against identity theft.

- Even insurance for your pet.

A State Farm Insurance agent can help you find ways to save money on your policy. Households can get discounts if no one has smoked in them in the last two years, if they have specific home security systems, or if they bundle their policies. Claim reporting is easy because there are many ways to do it. Policyholders can file claims online, over the phone, or through the Farmers mobile app.

How do you find an excellent residential property insurance provider?

It’s easy to make mistakes when looking for the best home insurance policy for your needs. Determine the value of your home and its contents as the initial step. Then, choose a provider and plan that affordably covers your essentials.

To obtain homeowner’s insurance, follow the steps below:

Determine beforehand how much risk you are willing to assume.

A standard homeowner’s insurance policy may not cover jewelry, artwork, and other collectibles. If your property contains a trampoline, a swimming pool, or anything else that could cause severe injury or death to a visitor, you may need to purchase additional insurance.

In addition, your homeowner’s insurance company or the National Flood Insurance Program will require you to purchase a separate flood insurance policy if you reside in a flood-prone area.

Similarly, if you live in an area prone to earthquakes, you should ensure sufficient insurance to cover potential damages. Consult the fault map of the United States Geological Survey to determine if you live in an earthquake-prone area.

Determine the amount of property insurance you need.

Gather and inventory your possessions. Save all relevant receipts to keep track of your spending. This article will assist you in determining how much home insurance coverage you need.

Consult an insurance company or real estate agent to determine, based on local averages, how much it would cost to rebuild your home and any outbuildings on your property.

If your home is damaged or rendered uninhabitable due to a natural disaster, you should budget for additional expenses such as hotel stays, restaurant meals, and other necessities.

Finally, select an insurer.

Finding an insurer that offers policies with the coverage and other features you need at an affordable price is a crucial step in determining the best homeowner’s insurance company.

Additionally, look for a company with a high financial strength rating from AM Best or another rating agency, positive reviews from consumers and experts, and around-the-clock availability should you need to file a claim or receive assistance.

Select a policy.

The best homeowner’s insurance policy will cover every possible contingency, offer straightforward coverage options, and may even save you money. Consider a replacement cost policy instead of a cash value policy, which only pays the depreciated value. This policy reimburses you for the cost of replacing your property with brand-new items.

Why do you need Resident Shield Insurance?

A reasonably priced renter’s insurance policy that protects one’s belongings and liability, you can quickly and easily obtain a policy if you do some quick math to determine how much protection you need and then apply for it online.

A flexible alternative to the traditional security deposit is advantageous to sign a lease without incurring debt. Resident Shield provides two renter’s insurance programs, both of which aim to reduce the likelihood of tenant-caused property damage.

Spending is kept to a minimum.

The monthly premiums for this kind of policy are $30,000 (property damage coverage) and $100,000 (liability coverage9. It ranges from $12 to $25. The monthly cost of insuring your property and yourself against loss is equivalent to a pizza slice.

In addition, renters’ insurance uses deductibles that determine the amount of the insured party’s financial responsibility in case you make a claim.

The contents of your home merit insurance coverage.

Estimate the cost of replacing the ten items in your place (most valuable) if they suffer severe damage. This is the amount your renters’ insurance would cover in case of a break-in, fire, or other damage to your apartment. Renters’ insurance provides two coverages: replacement cost coverage and actual cash value coverage.

Actual value coverage (cash) pays back to you for the depreciated value your belongings had at the time of the loss. On the other hand, replacement coverage pays to replace your damaged belongings. This value insurance premium is approximately 10 percent higher than the cash value insurance premium.

If you cause an accident, you get the coverage.

You must make amends if you cause someone harm or damage to their property (for an accident). These can occur to anyone at any time. Renters’ insurance typically includes personal liability coverage if you flood your downstairs neighbor’s apartment or someone suffers an injury in your home and presents a suit against you for medical expenses, a small premium to protect against lawsuits and medical bills (even for minor injuries can quickly add up) if you spend the money well.

You have an alternative haven if your apartment is destroyed.

Despite taking every precaution, accidents do occur. In the blink of an eye, a kitchen fire, a gas explosion, a burst pipe, or an electrical accident can render a home inhabitable. In a loss, renters’ insurance typically covers emergency housing costs, such as hotel stays or short-term rentals and meals.

It is possible to purchase additional protection for high-value items.

Valuables such as jewelry, collections, and company-owned electronic equipment are commonly out of standard insurance policies. The good news is that most renters’ insurance policies allow you to add a resource called “floater” that covers such items in the event of loss or damage.

As with any other type of residential structure, apartment buildings are susceptible to fire, smoke, theft, vandalism, explosion, and many other causes. Purchasing a Resident Shield renters’ insurance policy is a prudent way to guard against financial ruin.

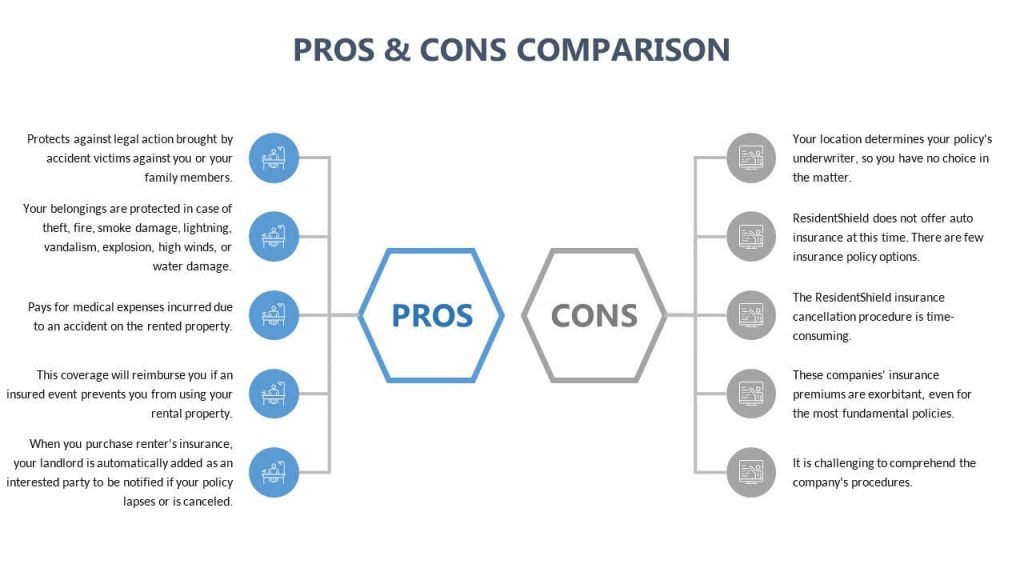

Pros and Cons of Resident Shield Insurance

Expert Opinion

Resident Shield Insurance Company is a group policy with over 100 million policies covering more than 2 million people in the United States. It offers homeowners and renters insurance as well as flood insurance.

Residents are covered by one policy per household or business unit in their home state or city. It does not provide coverage for commercial property owners who own residential properties. The Company also does not offer coverage for commercial property owners who own commercial properties.

It does not provide coverage for commercial owners of industrial properties such as warehouses or factories. It does not cover tenants in rental units under certain circumstances (such as if they have been evicted).