Even if it’s difficult to fathom today, there’s a good likelihood that you’ll need assistance caring for yourself in the future. The crucial question is: How are you going to pay for it? One option to be ready is to get long-term care insurance. A variety of services not included in standard health insurance are referred to as long-term care. This covers help with simple everyday tasks like showering, dressing, or rising and falling out of bed. At this point, the long-term care insurance calculator will be indispensable. Thus, we have made this post to aid you.

More than 70% of adults reaching 65 today will require long-term care at some time. Because of this, it is a problem that affects practically every home. And even though many individuals will require long-term care, not everybody uses long-term care insurance to cover the expenses.

However, long-term care comes at a high cost, and many individuals cannot pay the whole amount out of pocket. Extended daily care is not often covered by traditional employer-based insurance coverage; generally, health insurance only covers doctor and hospital expenditures.

Long-term care insurance may partially reduce the costs of long-term care requirements. Your circumstances and choices will determine if long-term insurance coverage is the best option. Come along as we elaborate on this for the Long-Term Care Insurance Calculator below.

What is Long-Term Care Insurance?

Nursing home care is covered by long-term care insurance. For those 65 years of age or older or with a chronic or debilitating condition that requires continual monitoring, this is in addition to home health care, personal care, and adult daycare. LTC insurance provides greater freedom and alternatives than many public assistance programs like Medicaid.

Unsurprisingly, long-term care requirements, services, and assistance are covered by long-term care insurance, another sort of insurance. In other words, it covers support requirements brought on by a chronic condition. In the same way, you buy individual life or medical coverage for yourself. This insurance is private. However, some types of long-term care insurance are created and offered as group plans.

Long-Term Care Insurance Calculator

Types of Long-Term Care Insurance

Long-Term Care Insurance comes in two primary varieties, giving customers more options than before. They consist of:

Long-term care insurance policies that stand alone

Stand-alone LTCI plans, also called Traditional Long Term Care Insurance, provide the most straightforward and cost-effective way to cover long-term care costs. Over 40 years have passed since these policies were accessible. If you need help with at least two out of the six activities of daily living, most plans cover the actual cost of care up to your plan limitations.

Plans for Hybrid Long-Term Care

Asset-based Long Term Care Coverage is another name for a hybrid long-term care insurance plan. Typically, two different forms of insurance are combined into one: either life insurance or a long-term care insurance rider on a qualified annuity.

You may modify an existing annuity or permanent life insurance plan to include an LTCI rider. The rider will have the same fundamental elements as the aforementioned stand-alone plans. Hybrid plans haven’t been available as long as stand-alone plans, but their popularity is increasing quickly.

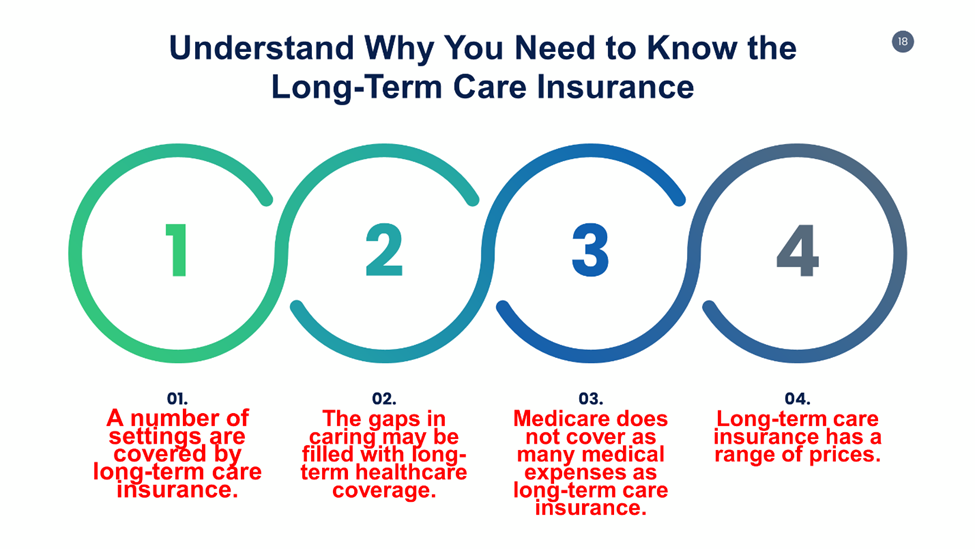

Understand Why You Need to Know the Long-Term Care Insurance

Long-term care is referred to help with medical or personal requirements for a prolonged period of time. These elements might assist you in deciding whether you should seek LTCI as you make financial plans for the future.

Some settings are covered by long-term care insurance.

Most people picture nursing homes when they think about long-term care. However, 73% of those who need long-term care do it at home rather than in healthcare facilities or assisted living centers.

Long-term care is required when a person cannot carry out everyday tasks, including clothing, feeding, showering, or relocating. And a home health assistant may often provide this assistance to you in the comfort of your home.

While it’s not always nice to consider situations where long-term care may be required, LTCI can assist in covering the expenses. It could provide a means for you to get care at home rather than in a nursing home or assisted living facility.

The gaps in caring may be filled with long-term healthcare coverage.

Whether long-term care becomes essential, it is hard to say with certainty if your family will be able to take care of you. It may be very expensive and emotionally taxing to provide care. Furthermore, 66% of carers wind up utilizing their pensions and savings money to pay for care due to the high expense of long-term care. Additionally, the practicality of caregiving may not be possible if your relatives live far away or cannot balance it with their job or family commitments.

Medicare does not cover as many medical expenses as long-term care insurance.

Long-term care is often not covered by Medicare, and it only sometimes pays for the care given at home. Only for brief periods does Medicare pay for care practices in a nursing home. You can be recovering during this period after a hospitalization for a connected ailment.

However, long-term care is not the same as that. Medicare won’t cover such expenses after your care requirements have stabilized and you require personal or custodial care. At this point, you’ll require long-term insurance coverage.

Long-term care insurance has a range of prices.

Your age and the coverage the insurance will provide if you need it will affect pricing. According to research by the American Association for Long-Term Healthcare Coverage, a couple that chooses an initial insurance payout of $165,000 may reach the age of 55. As a result, they will each pay a yearly premium of $2,080. The cost would increase to $3,750 a year for a couple who are both 65 years old.

This can also be seen in the infographics below.

Risk & Profit in Long-Term Care Insurance

The Risk & Profit of Long Term Care Insurance has been highlighted in the table below.

| Risk | Profit |

| It might be difficult to estimate how much coverage you could need. | LTCI gives you the assurance that a substantial percentage of your future requirements will be covered. |

| Getting long-term care insurance may well be dangerous since it can be difficult to predict the level of benefits you could need in the future. | It’s good if you’re confident to utilize it. |

| Incentives may not be provided when you need them, and you probably need long-term care. | A fixed percentage of the monthly or yearly expenditures would be covered by your long-term care insurance. |

| During your stay, there is less strain on your assets. By doing this, you’ll be able to keep more of your savings and potentially have more cash to leave your loved ones in the future. | |

| Long-term care coverage is guaranteed as long as you continue to pay the payments. |

Frequently Asked Questions

Who pays the most long-term care costs?

Services for long-term care are generally funded through public funds. And the greatest portion is often paid for by Medicaid, a joint federal-state health program for those with low incomes.

What percentage of your income should you spend on long-term care insurance?

Some professionals advise you to spend no more than 5% of your salary on a long-term care insurance policy.

Which insurance policies exclude the majority of long-term care expenses?

Long-term care is not often covered by health insurance. Medicare won’t help either; it only pays for brief nursing home stays or a small amount of in-home care if you need skilled nursing or rehabilitation.

What is the biggest drawback of long-term care insurance?

Long-term care insurance’s largest downside is the impact of the waiting period on your health. You don’t know how your condition will be in twenty years or if you’ll still be able to get insurance. Long-term care healthcare costs are not locked in and may increase at the insurers’ discretion.

Is long-term care insurance a waste of money?

Although it is not an asset, long-term insurance coverage may provide stability. Contrary to life insurance, which is assured to pay, long-term healthcare coverage will be lost if you don’t utilize it. Your chances of never receiving much, if anything, from long-term care insurance coverage, are quite high.

What are the three types of long-term care insurance?

There are three types of long-term care insurance.

- Conventional procedures;

- Hybrid regulations; and

- Policies as part of a Continuing Care Retirement Community package.

Is long-term care insurance tax deductible?

Based on age, the IRS permits qualifying individuals to write off a part of their long-term care insurance costs on their tax returns.

Expert Opinion

Government statistics indicate that 70% of seniors over 65 will eventually need long-term care and assistance. Thus, long-term care insurance (LTC) may assist you in covering the expenses of your care as you age and need assistance with daily chores. In addition, care for dementia, Parkinson’s disease, and Alzheimer’s disease is provided.

About 60% of us will need help with daily activities like getting dressed, traveling to meetings, or preparing meals at some time in our lives. When you picture your retirement, you may not pause to consider, “What if I’m incapable of performing the things I can do presently?” The main focus of long-term care is getting assistance with daily tasks. At this point, the Long-Term Care Insurance Calculator will aid you greatly.

References