Owning a vehicle has recently evolved from a status symbol to a necessity. Everybody considers owning a vehicle to be a significant milestone in their lives. After purchasing a vehicle, getting auto insurance is a wise decision. A comprehensive auto insurance policy will serve as a financial buffer against unforeseen collisions and other small traffic disasters. The law in the United States requires you to get automobile insurance, which will keep you and your automobile safe at all times. Each person with automobile insurance coverage must also contribute to the plan’s cost by paying a premium. You may use an auto insurance premium calculator to see how much you must pay. Thus, we have made this post to aid you. Come along!

What is an Auto Insurance Premium Calculator?

A user may search, evaluate, and purchase vehicle insurance quotes from the many car insurance providers using an internet application called an auto insurance premium calculator. Additionally, you may compute premium quotations depending on your needs to choose the best vehicle insurance policy.

The best tool offered by insurance providers is a premium auto insurance calculator. Online price rates for auto insurance are available from all insurance companies. Fill out the required areas on the car insurance calculator page with information about the car and the policy to determine your car’s precise premium.

Are the premiums being paid for the correct coverage? Policyholders wonder. By contrasting the list of auto insurance rates, a policyholder may dispel any questions they may have. Every policyholder should use a vehicle insurance calculator to customize the perfect coverage for their needs.

Customers do not need to estimate the premium amount using this vehicle insurance calculator online. As a result, they may compare their plans using particular criteria and choose the best insurance plan. Another benefit of using an auto insurance calculator is knowing the coverage limits and deductibles for the premium.

Auto Insurance Premium Calculator

How to Calculate an Auto Insurance Premium

You can calculate an Auto Insurance Premium through the following steps:

Step 1: Sort out the Damage Premium

The largest consideration in determining the premium is the damage premium. You can select Third-party, Own Damage, or Comprehensive coverage. Several companies provide various special flavors of Damage Premium.

Step 2: Get your No Claim Bonus

The NCB, as its name indicates, is a discount for not making a claim the year before. Even if you change insurance carriers, NCB is still preserved. For each year without a subsequent claim, the NCB discount rises, reaching a maximum 50% reduction on the premium.

Step 3: Get the possible Discounts.

Most insurance companies give discounts for good conduct, including safe driving, renewing policies before expiration, and much more. They may be used to improve coverage or reduce premium costs.

Step 4: Get the Insured Declared Value

IDV is the used car’s current market value. In the case of complete damage or theft, the insurer will pay the IDV sum under comprehensive coverage. IDV increases cause premiums to rise.

Step 5: Sort out the Add-Ons

For your coverage, you can add extra features like Zero Degradation, Engine Shield, Driver Assistance, and more. These are often referred to as “add-ons.” They are more expensive than your standard policy.

Step 6: Apply the appropriate formula.

This simple formula will help you solve the car insurance premium calculation easily.

Premium = Own Damage Premium – (No claim bonus + discounts) + Insured Declared Value + Cost of Add-ons

Understand Why You Need to Know the Auto Insurance Premium

The yearly cost of your vehicle insurance coverage is known as a premium and is sometimes referred to as an insurance rate. Most vehicle insurers provide six-month insurance, although some also provide yearlong coverage. There may be extra installment costs if you want to pay it in full at once rather than monthly.

To maintain their coverage, drivers pay a fee for their auto insurance. Your insurance provider pledges to defend you and your car in the case of an accident or other authorized loss as long as you keep paying the auto insurance payments on time. The insurer can terminate your coverage after a specified time if you stop paying the payment. You won’t have vehicle insurance coverage if the policy is terminated so an accident won’t be covered.

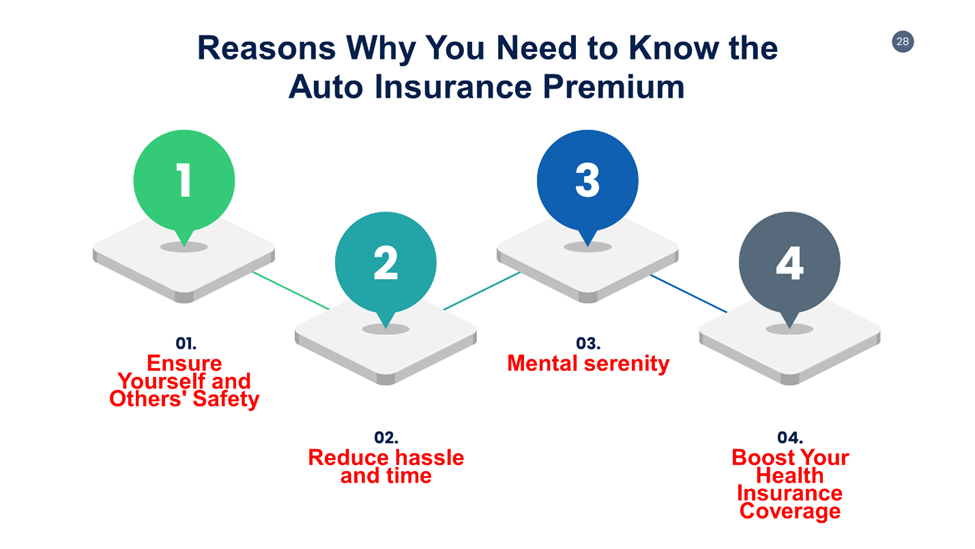

Some reasons why you need to Know the Auto Insurance Premium include:

Ensure Yourself and Others’ Safety

The correct auto insurance premium may assist in ensuring the safety of you, your loved ones, your guests, and other motorists. If an accident occurs, you want to be sure that you have the correct coverage to pay for any potential property damage or physical injury charges. To find out how you can assist in protecting yourself and your family, get a vehicle insurance estimate online or contact a representative right now.

Reduce hassle and time

The repercussions of an auto crash may be tremendously stressful and time-consuming. Managing the expenses of restoring or replacing your car and dealing with other drivers and landlords implicated in the mishap may be avoided with the right auto insurance premium. Many of these problems may be handled with good auto insurance.

A reliable car insurance plan may support removals, restorations, and replacements and compensate for losses to other motorists. The insurer may support you with administering the processes and helping you if you file a vehicle insurance claim.

Mental serenity

Everyone errs sometimes. However, there are situations when another driver’s error becomes your issue. You may feel secure knowing that you are covered if you have the appropriate auto insurance premium if an uninsured or impaired motorist strikes you.

Boost Your Health Insurance Coverage

Your liability coverage can assist you in addressing hospital expenses that your health coverage usually won’t be paying for. A robust vehicle insurance plan may offset essential dentures and basic healthcare costs after a collision.

Risk vs. Profit in Auto Insurance Premium

The Risk vs. Profit in Auto Insurance Premium has been highlighted in the table below.

| Risk | Profit |

| Possible Coverage omissions | Assurance of financial responsibility |

| Sometimes, the process of ensuring repairs and replacements takes a while. | Reduces responsibility for the driver and passengers |

| A possibility of poor customer service exists for medical claims | Provides hassle-free claim resolution |

| There is personal accident insurance. | |

| Legal requirements apply. |

Frequently Asked Questions

Who normally has the cheapest car insurance?

Regarding national insurers, USAA offers the most affordable rates at $36 per month, followed by State Farm at $44 monthly.

How can you decrease your insurance rates?

Here are some strategies to lower your insurance costs:

- Increase your deductible amount.

- Look into any discounts you may be eligible for.

- Compare prices on car insurance.

- Keep a clean driving record.

- Take part in a campaign to promote safe driving.

- Enroll in a driving safety course.

- Look into your payment alternatives.

- Boost your credit rating.

Which is a type of insurance to avoid?

Some types of insurance to avoid include:

Private Mortgage Insurance

- Extended Warranties

- Car Rental Damage Insurance

What is the simplest way to lower your auto insurance premium?

Shopping around with at least three different auto insurance providers is the fastest and simplest approach to lower auto insurance premiums.

Does credit score affect car insurance?

Yes. Your auto insurance premium is often considerably reduced by a better credit score with practically every business and in most states. However, getting a quotation has no impact on your credit. Your credit score plays a significant role in deciding your auto insurance cost.

Which age group pays the highest premiums for auto insurance?

16 to 19-year-olds are the age group that incurs the highest premiums for auto insurance. For instance, each year, 16-year-olds spend $3,343 on average for the bare minimum of auto insurance protection. This is more than four times what the typical motorist pays annually.

What makes car insurance high?

Your age, riding history, credit score, coverage choices, the kind of vehicle you drive, and the area where you reside are all common factors that affect how much your car insurance will cost. Car insurance rates will rise as a consequence of anything that insurers can tie to a larger chance that you’ll get into an accident and submit a claim.

How much does car insurance go down after 1 year of no claims?

Each insurance provider has its no-claims bonus scheme. However, a common example may be a 30% reduction after one year of insurance without a claim. Additionally, there is a 40% reduction after two years and a 50% discount after three years.

Expert Opinion

Car owners are required to get coverage for their vehicles. Every automobile owner purchases car insurance coverage for this reason. Nevertheless, many people are unaware of the formula used to determine the policy’s premium. In these situations, a car insurance premium calculator is useful. Based on the specifications of the vehicle, the calculator assists in determining the insurance policy premium.

You may use a tool to determine the precise amount of premium insurance you should be paying, the auto insurance premium calculator. It lets you quickly verify and compare premium estimates from various insurance companies’ premium computations.

Enter a few simple data about your automobile, then sit back to discover the precise premium amount you must pay for car coverage. This makes it possible for someone to choose the greatest auto insurance option while staying within their means.