What does car rental insurance cover? Renting a car does not necessitate the possession of your auto insurance policy. When renting a car from a rental agency, you may be accountable for a large portion of the cost if you get into an accident.

In addition to the rental car company’s insurance, you can purchase supplementary insurance, use a credit card, or get a separate policy from a third party.

Insurance for a rental car is notoriously difficult to understand. The story of a traveller shocked to receive an $810 fee for scratching a bumper after renting a car in Belgium caught our attention lately. They lost their insurance since the rental car company compelled them to get additional coverage (with a deductible of 600 euros)! That’s not right at all.

The one-trip Rental Car Protector from Allianz Global Assistance is a solution to this problem if you go there. For only $11 per calendar day, you may get worldwide coverage for your rental automobile in case of a collision or other damage. Is there a limit to what this form of insurance covers?

What does the rental car collision damage waiver cover?

A CDW can cover more than just the rental car’s collision damage. If a vehicle you’re renting suffers damages in an accident or while you leave it unattended, you’ll get $50,000 in cost coverage.

I’m curious to know what those costs are. Repair or replacement costs (whichever is less) come with the one-trip Rental Car Protector, which compensates for the owner’s reasonable loss of use fees while they repair their vehicle. When the rental automobile goes under repair, the company loses money. We use the rental car’s cash value minus its fair salvage value as the replacement cost.

The one-trip Rental Car Protector provides you with principal protection. First comes primary coverage, which implies that if you have a claim for damage or loss, the policy will pay first.

Credit card collision damage coverage is often secondary, meaning it comes in after your regular auto insurance policy.

Get a one-trip rental car.

One trip Rental Car Protector comes with two extra benefits people don’t know well. For example, you may be eligible for a trip interruption benefit of up to $1,000, which will pay for any unused, non-refundable portion of your vacation and any additional transportation costs you incur returning home due to a covered reason.

For example, if you have to cut your trip short due to your daughter’s critical illness, this benefit may compensate you for a non-refundable rental car, hotel, and aircraft ticket fees.

Secondly, our emergency hotline is entirely free of charge. A lifesaver!

Why is it important to buy a collision damage waiver?

The reason is big, an unexpected bill from the rental car company can ruin your trip more than anything else.

Having a collision damage waiver is essential if your rental car suffers damages in a collision. Worse, if someone steals your rental car when you leave your hotel. (Countries with the most excellent auto theft rates are Uruguay, New Zealand, the Bahamas, and Italy, which may surprise you.

Who is to blame doesn’t matter because the waiver will cover the hefty repair or replacement costs. The rental car company may argue that you damaged the vehicle even if you didn’t. A rental car firm may charge a customer for damage the customer claims they did not do. Unfortunately, this is a typical occurrence.

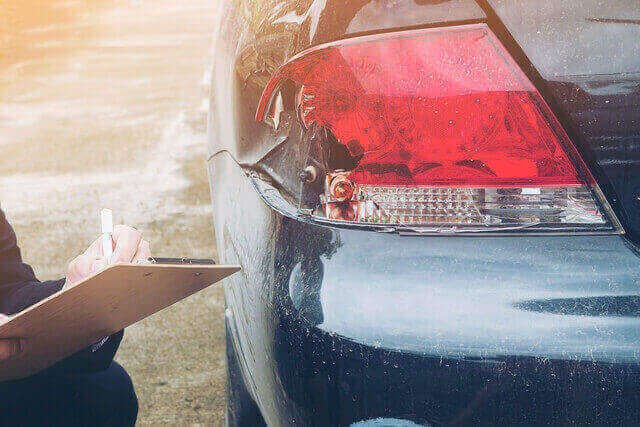

If you drop off your automobile after the office closes and staff hasn’t had a chance to inspect it, you could be liable for damage that you didn’t do. Another regular occurrence is when a rental automobile company neglects to account for the damage that has already occurred. Make sure you snap many pictures when you pick up and drop off the car.

Essential Things to Know About Rental Car Insurance

On average, rental car insurance costs are $61 per day, although it varies depending on your coverage and where you’re renting the vehicle.

Coverage for rental cars is frequently provided through personal auto and healthcare policies and credit card perks.

When should you buy extra rental car insurance?

Do you need the rental agency’s insurance when you have many other options?

You will not receive coverage from any insurance policies that you have. Car insurance from the rental business may be the easiest option for those without their policy.

It is using a debit card or cash as a mode of payment. Collision protection is not part of debit cards like credit cards.

In an accident, you may be unable to afford to pay the deductibles on your health and car insurance policies.

The Expenses that you don’t afford with other options, and insurance policies may not cover some expenditures.

What about travelling internationally?

Depending on where you go, your insurance and credit card benefits may be less comprehensive than at home.

Want to avoid wasting money? Hold on to your credit card if you return a damaged automobile to prevent a credit card. Several rental car companies require you to purchase an additional damage waiver.

Trips for work: If you’re on a work trip, you may not receive the coverage from your insurance policy. You may need supplementary insurance if your company does not supply it.

Rentals for a long time: Your credit card’s collision coverage is only valid for 15 days if you rely on it. If the rental is used or scheduled for a more extended period, insurance may be void for the entire rental period, not just the extra days.

How to tell if you need rental car insurance coverage

You first need to verify your policy to determine whether or not you already have the range for rental cars in your personal auto insurance policy. Rental car coverage often extends to your vehicle in the US if you have comprehensive liability coverage.

When renting an automobile in the United States that is of a similar value to your vehicle, you will receive coverage by your own auto insurance policy.

What is covered under a typical rental car insurance policy?

The rental car insurance options most firms offer have limitations. Before you walk up to the counter, familiarize yourself with the rental company’s policies.

Typically, rental automobile insurance is divided down into the following coverages:

- Liability Coverage

- Insurance coverage in the event of a personal injury

- Damage Waiver

- Loss Damage Waiver

- Coverage for Personal accidents

Conclusion

Whether driving your car or renting one, an accident will likely raise your insurance premiums, if you have rental car insurance through your auto insurance provider or a credit card business, this is especially essential for you to keep this in mind.

When you submit a claim on your vehicle insurance policy, the company will know that you were involved in an accident and will likely raise your premium.

Rental automobile insurance is required for some drivers. Others see it as a wasteful expenditure.

So, it’s good to check your personal auto insurance policy before hiring for a car. In other words, acquiring additional coverage may not make sense if you’re already paying for rental car insurance.

Some renters may find it worthwhile to pay the additional fee for the insurance provided by the rental company. You should know what your auto insurance covers and what the rental car company offers because of this.