Automobiles are a marvel of human engineering. Driving, on the other hand, can result in a variety of unanticipated issues. This is why it is necessary to train before purchasing a vehicle. Aside from learning how to drive a car, you should also purchase comprehensive car insurance, which will protect you and your vehicle financially from damage caused by accidents, natural disasters, riots, and other factors. As a result, here’s a rundown of how to get insurance to cover a blown motor.

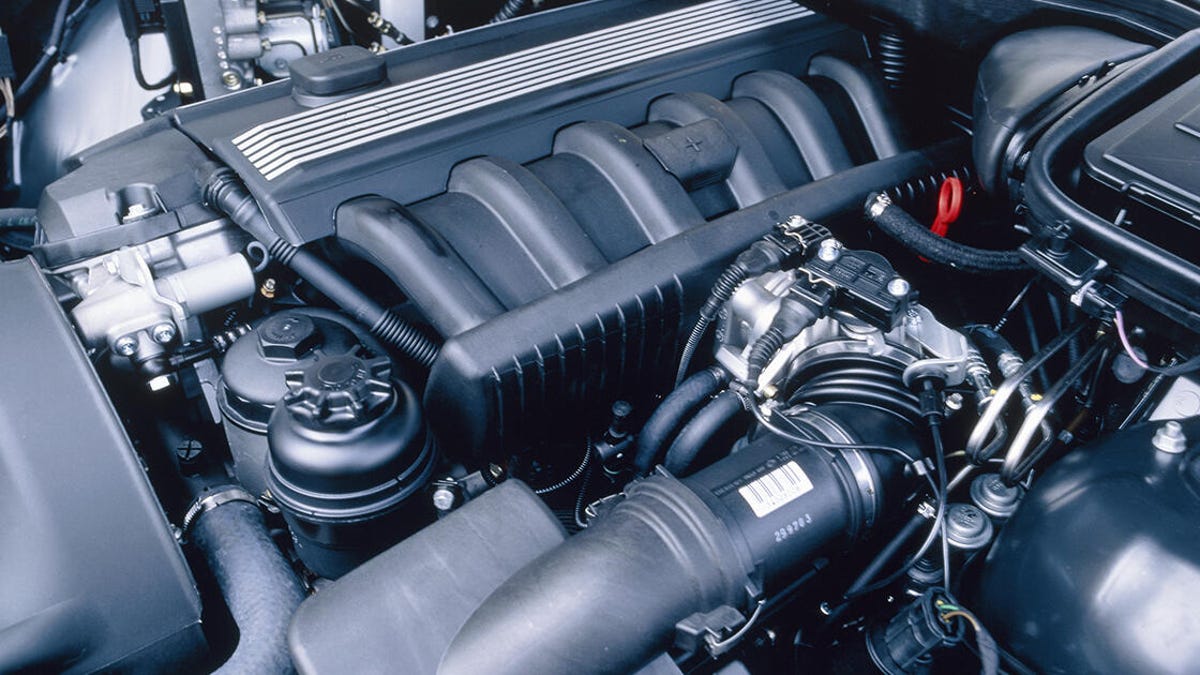

Furthermore, your car’s motor performs the same function as your own heart! It’s what gives your car life. Is it possible to live without a heart? Without a motor, neither can your car! As a result, it’s critical to keep your motor in good working order by having it serviced regularly.

This is similar to having regular check-ups to ensure that your health is in tip-top shape. However, no matter how well you maintain your automobile, the motor is subject to normal wear and strain, and critical parts can fail due to unanticipated conditions. Just like it’s impossible to predict a heart attack, if we may say so! As a result, it’s best to figure how to get insurance to cover a blown motor.

What does Coverage for Motor Entail?

A motor protection policy adds to automobile insurance that provides financial protection against damage to an insured motor. This add-on will handle the cost of fixing the motor and its component. You should be aware that your extensive auto insurance will cover any damage to your vehicle’s motor or components.

Water infiltration, hydrostatic lock, and other factors might cause damage to the motor of your insured vehicle. Because the motor is the most expensive vehicle component, its repair costs can be rather high. Also, if water gets into the motor, it might cause problems. As a result, if you reside in a flood-prone area, this is must-have insurance. Repairing a blown motor and its parts can eat into your funds, so it’s wise to purchase blown motor insurance.

Types of Insurance Cover a Blown Motor

One of the most inconvenient things that can happen to your vehicle is for the motor to stop working, leaving you stranded on the side of the road. This is why having roadside help is usually a good idea, but it’s better to get the insurance that covers a blown motor.

It is also critical to comprehend that a regular automobile insurance policy is unlikely to cover a mechanical issue, typically a motor failure. There are, however, extra automobile insurance alternatives that will cover a blown motor. Here are a few examples:

Collision protection insurance

You may be wondering, how do I get insurance to cover a blown motor? Collision and comprehensive cover stand as a great choice for you. Collision coverage can shield your motor against damage caused by colliding with a building, a barricade, or another vehicle.

If your motor breakdown was caused by an accident, your insurer or auto insurance provider might be able to reimburse you for your losses. However, as with other claims, there will certainly be a deductible.

Full coverage insurance

Comprehensive coverage is a sort of insurance that, in some situations, can cover a blown motor. This coverage, like collision coverage, is normally considered an add-on to a standard policy, and you must purchase it separately.

Comprehensive insurance, on the other hand, may cover a blown motor caused immediately by accident. It is the driver’s responsibility to demonstrate that the blown motor was caused by an accident. You can accomplish this by having your mechanic inspect the damage and verify your claim.

A blown motor may get coverage under a comprehensive insurance policy if it is caused by any of the other factors included in your policy, such as weather damage. Both comprehensive and collision coverage are normally considered optional.

Alternatives to blown auto insurance

Mechanical Breakdown Insurance, or MBI, is a coverage option available on some car insurance policies. This can refer to a variety of mechanical concerns, such as a blown motor. It’s worth mentioning that MBI isn’t available from all insurance carriers, and it usually only applies to newer vehicles. Furthermore, having MBI can lead to higher deductibles.

How to Get Insurance to Cover Blown Motor

A car’s motor is one of its most expensive components, and any motor repair work can be costly. Thus, the motor protection cover is an add-on cover in a motor insurance plan that covers any damage or loss to the covered motor.

On payment of an additional premium, it covers the expense of repairing or replacing your automobile’s motor or/and its parts under your car insurance policy. It also allows you to receive financial assistance from your auto insurance company if your motor fails.

Overall, you may purchase motor protection as an add-on to your comprehensive auto insurance policy. This is an optional coverage that is not included in a typical comprehensive policy. The processes to getting insurance to cover a blown motor include:

Step 1: Pay a visit to your auto insurance provider. You can also use their website or mobile app to find out more information.

Step 2: Choose whether to purchase or renew your comprehensive auto insurance.

Step 3: If you’re asked to include add-ons like motor protection, choose yes.

4 Step: Pay the premium, and they will send your insurance to your email address immediately.

Which Companies Provide Coverage for a Blown Motor?

The following companies typically provide coverage for a blown motor:

GEICO

GEICO is the ideal option if you’re looking for a superb insurance company that offers cheap rates and a long range of fantastic discounts to cover a blown motor. Furthermore, some of the incredible features in the GEICO mobile app truly set this organization apart from the rest of the nation’s top insurance providers.

GEICO offers coverage for several vehicles, including all-terrain vehicles (ATVs), boats, and recreational vehicles (RVs). In addition, other types of coverage, such as homeowners and renters insurance, are available via the provider, and you can combine them with your auto insurance.

State Farm Insurance

State Farm does not have as many digital perks as some other huge insurance firms, but it does have a large network of agents who can assist you with your insurance requirements at any time. Furthermore, State Farm is one of the industry’s oldest insurance firms, having a proven track record of helping consumers with blown motors.

State Farm has become a household name for a range of insurance products throughout the last century, including blown motor coverage. It also maintains a network of employees across the United States, which means you’ll always have access to a local State Farm advisor for your insurance queries and requirements. This is becoming increasingly usual in this computerized, outsourcing age.

Amica Mutual Insurance Company

While Amica Mutual does not provide special savings or digital extras, its reputation for customer service and claim settlement speaks for them. And their prices aren’t outrageous; when it comes to coverage for blown motors, they’re among the best.

In addition, Amica, like most other auto insurance companies, provides all of the needed and useful coverage. This covers 24-hour roadside assistance, payment for rental cars, and even glass insurance (repairing your windshield without incurring a deductible).

USAA

You should take advantage of USAA’s blown motor insurance coverage if you satisfy the requirements. The organization offers competitive rates, significant savings for active military personnel, and a fantastic online experience. If a close relative has military ties, USAA’s blown motor coverage is unquestionably the finest option.

The well-known financial organization, which is open to current and retired military personnel and their immediate family (spouses and children), has some of the lowest premiums in the business and provides excellent customer service.

Progressive

Progressive’s cheap blown motor cover options, in particular, stand out. The company also demonstrates a strong readiness to insure high-risk drivers. As a result, any driver with a history of accidents or other problems on their driving record should strongly consider Progressive. In addition, we recommend that you join the Snapshot program and use your current record to help lower the rates that your history may have influenced.

Frequently Asked Questions

Will car insurance cover a blown motor?

Yes. Car insurance may cover a motor that has been blown in a collision or accident, depending on your coverage. However, a blown motor caused by natural wear and tear does not get covered by auto insurance.

Is insurance cover for a blown motor worth it?

Yes. Insurance cover for a blown motor is worth it, as it comes with diverse merits.

How much does blown motor insurance cost?

You will be expected to pay between $400 to $1000 for blown motor insurance.

Which insurance firms offer coverage for a blown motor?

The following insurance firms usually offer coverage for blown motor:

- GEICO

- State Farm

- Amica Mutual

- USAA

- Progressive

Conclusion

In conclusion, insurance comes with diverse merits. And if you desire more help on how to get insurance to cover blown motor, the tips above will aid you immensely.